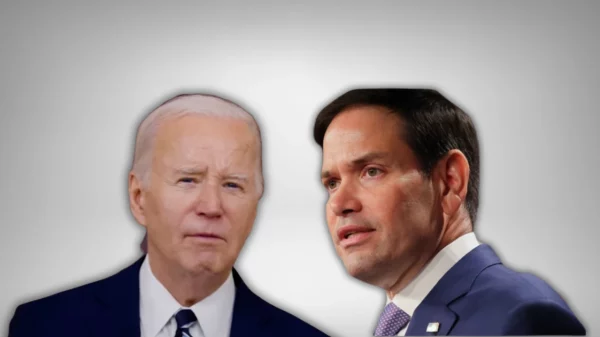

U.S. Sens. Marco Rubio, R-Fla., Maggie Hassan, D-NH, and seven other senators urged the U.S. Department of Veterans Affairs (VA) to help more veterans and military families purchase homes by providing additional flexibilities under the VA Home Loan Guaranty Program, as well as additional education and outreach to real estate agents, mortgage lenders, and veterans about the VA Home Loan process.

Dear Secretary McDonough:

We would like to commend the Department of Veterans Affairs (VA) for its commitment to providing sustainable financing and housing options to veterans who have dedicated their lives to serving our great nation. But we write today to urge the VA to help more veterans and military families purchase homes by considering additional flexibilities for the VA Home Loan Guaranty program and review its outreach and education program for real estate agents, lenders, and veterans.

The VA Home Loan Guaranty program was established more than 75 years ago to even the playing field for returning service members and provide access to the American Dream they pledged their lives to defend. Generations of veterans and service members have turned to this benefit to achieve the dream of homeownership, and participation has only increased since the Great Recession.

However, in this housing market, veterans and military families are struggling to compete with other buyers when using the VA Home Loan Guaranty program. Housing inventory is at an all time low, accelerating increases in home prices. Unfortunately, while the VA’s appraisal process is rooted in safety and sustainability, some aspects may put veterans at a disadvantage in the current marketplace. The VA appraisal process reviews a home in comparison to comparable properties in the area, but it can often come in lower than the asking price. This results in veteran homebuyers paying the difference in cash at closing, or being unable to move forward with a purchase. While they can ask for a Reconsideration of Value (ROV), many first-time veteran homebuyers, agents, and lenders do not know about this appeal process. In addition, because of the VA process, some home sellers will not even consider buyers relying on VA loans.

For this reason, we ask that VA review its appraisal and ROV policies and practices for any flexibilities that would improve the accuracy of valuations given this period of housing supply shortage and increased home values. Creating temporary flexibilities in these valuation policies will help place veterans and service members on a more equal playing field with other homebuyers in this market.

Furthermore, while veterans can ask for a ROV, many first-time veteran homebuyers, agents, and lenders do not know about this appeal process. Therefore, we recommend that VA provide additional education and outreach to veterans and real estate agents regarding the ROV process.

We also ask for greater education and outreach about the VA home loan process using VA expertise more broadly to support continuing education requirements. Unfamiliarity or uncertainty with how this program works can discourage real estate agents and sellers from accepting an offer from a veteran or inhibit a veteran from using this benefit. The VA should assist realtor associations in developing a targeted continuing education program for the VA Home Loan Guaranty program. Improved education about the policy will help real estate agents, lenders and veterans feel more comfortable about fees and the appraisal process, for example, increasing the number of veterans benefiting from the program.

With COVID-19 only exacerbating the housing crisis, there must be a continued effort to assist veterans with finding permanent housing in this highly competitive market. With this in mind, we ask that you consider additional flexibilities regarding valuation for the VA Home Loan Guaranty program, while providing comprehensive education about the program for veteran homebuyers, realtors, and lenders. The VA serves as a cornerstone of our nation’s system to provide care for veterans. We ask for your committed leadership to ensure that veterans continue to receive the help that they need when transitioning back to civilian life. As Members of Congress we stand ready to assist in these efforts and look forward to working with you to ensure that no veteran is left behind.