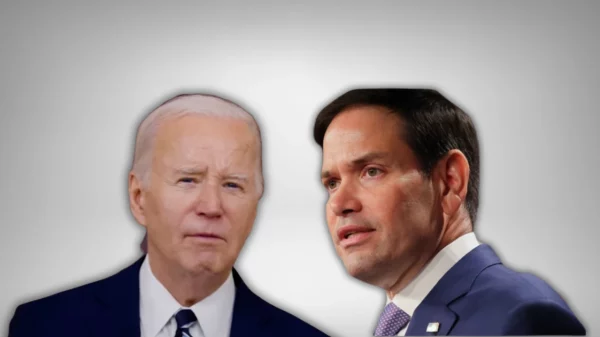

On Tuesday, U.S. Sens. Marco Rubio, R-Fla., and Dianne Feinstein, D-Calif., called on the Commodity Futures Trading Commission, the first federal financial regulator to create a climate risk working group, to include specific recommendations for addressing the financial risk of climate change in the upcoming report by its Climate-Related Market Risk Subcommittee.

“Senator Rubio has advocated for common-sense measures that will help Florida adapt to and mitigate the risks of extreme weather, rising sea levels, and other climate-related risks. These long-term challenges include risks to the financial system and the financial well-being of Floridians. Senator Rubio hopes that the CFTC will provide reasonable, responsible, non-ideological, and common-sense recommendations to federal financial regulators seeking to understand and mitigate the risks of climate change to the U.S. financial system,” the senator’s office noted.

The full text of the letter is below.

Dear Chairman Litterman:

We write to commend the Commodity Futures Trading Commission (CFTC) for creating the Climate-Related Market Risk Subcommittee and offer public comments in advance of its report. We appreciate that the CFTC recognizes the importance of climate change risk, and we encourage you to produce robust and specific recommendations for understanding and mitigating the risks of climate change to the U.S. financial system.

Increasingly, floods, hurricanes, wildfires, and other natural disasters and extreme weather events threaten not only the safety and property of millions of Americans, but also the stability of the financial system. In recent years, wildfires preceded by severe drought-inducing climate patterns have ravaged the West and inflicted a devastating toll on homeowners, businesses, and industries critical to the economy. Similarly, recent financial effects have been incurred by the impacts of unrelenting tropical weather along the Gulf Coast, U.S. territories and Eastern Seaboard. This year could see a continuation of these patterns, with the National Oceanic and Atmospheric Administration (NOAA) and National Interagency Fire Center (NIFC) predicting the possibility of an above average hurricane and wildfire season. Climate change and rising natural disaster risk have raised insurance premiums and reduced the value of high-risk land and related assets. NOAA estimates that weather and climate disasters cost the U.S. $807 billion between 2010 and 2019 and approximately $1.77 trillion since 1980. Such realities place the assets and financial institutions that underlie the U.S. financial system at great risk, as recent history demonstrates.

Because the Subcommittee’s report will be the first of its kind for federal financial regulators, you have an opportunity to make recommendations that not only guide the CFTC, but could help to inform other U.S. regulators as well. Specifically, we ask that your forthcoming recommendations address the questions we have attached. Most experts understand that climate risk is a serious source of financial instability, and we are pleased to see a U.S. financial regulatory agency make recommendations that multiple federal regulators may be able to use as a model. It is essential to adapt our financial system to climate-related risks, and we look forward to reviewing the Subcommittee’s recommendations.