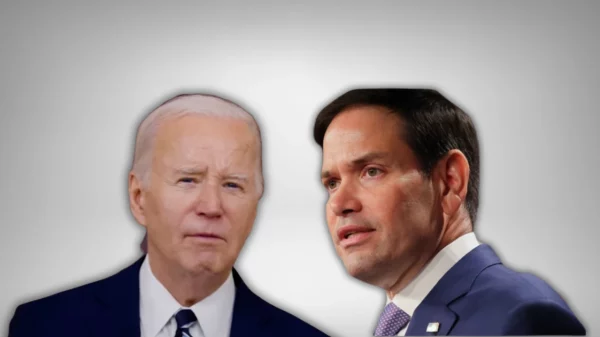

This week, U.S. Sen. Marco Rubio, R-Fla., the chairman of the U.S. Senate Small Business and Entrepreneurship Committee, looked to continue relief efforts for small businesses during the coronavirus pandemic.

Rubio introduced the “Continuing Small Business Recovery and Paycheck Protection Program Act” as he hopes to build off of the Paycheck Protection Program (PPP) and the $2.3 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act passed by Congress and approved by the White House at the end of March.

The Florida Republican’s office offered some of the rationales behind his new proposal.

“The package aims to ensure small businesses, including minority-owned firms and those in underserved communities, have the necessary resources to weather the COVID-19 pandemic. The bill would allow the most severely affected small businesses to receive a second PPP loan. It would also create a new long-term recovery loan program, which would provide working capital to industries that have been hardest hit by the COVID-19 pandemic. The nearly $60 billion long-term recovery loan program would target low-income communities, minority-owned, and seasonal businesses,” Rubio’s office noted.

“The PPP and the other small business provisions under the CARES Act have been an historic lifeline to millions of small businesses and tens of millions of American workers,” Rubio said. “Now, Congress must take action to help industries and businesses, especially minority-owned small businesses and those in low-income communities, that have been hit hard by the COVID-19 pandemic. Today, Senator Collins and I are announcing our proposal for a second round of PPP that is targeted at helping minority-owned small businesses and includes a new, long-term recovery loan program. I look forward to continuing to work with Senators Cardin and Shaheen to build on this proposal and come up with another bipartisan program to help small businesses and their workers.”

As Rubio noted, U.S. Sen. Susan Collins, R-Maine, a top target for Democrats in November, is also backing the proposal.

“The Paycheck Protection Program has been a tremendous success. In Maine alone, approximately 3 out of 4 small businesses and 240,000 jobs are supported by the PPP. Since its launch in early April, it has provided $519 billion in forgivable loans to 4.9 million small employers around the nation,” said Collins. “The bill we are introducing today to allow the hardest-hit small businesses to apply for a second forgivable PPP loan builds on the strong foundation Senators Rubio, Cardin, Shaheen, and I built as members of the Small Business Task Force.”

Rubio’s office offered the following details on the proposal:

Long-term Recovery Sector Loans: Create a guaranteed long-term, low-interest working capital product by improving the terms of 7(a) loans for seasonal businesses and businesses located in low-income communities. The loans would equal 2x the borrowers’ annual revenues, up to $10 million, with a maturity of up to 20 years at an interest rate that is fixed at one percent to the borrower. The bill would allow businesses with 500 employees or fewer and have seen their revenues decline by 50 percent or more in the first or second quarter this year compared to the same quarter last year.

PPP Second Draw Loans: Provide funds to allow the hardest-hit small employers – those that have seen their revenues decline by 50 percent or more in the first or second quarter this year compared to the same quarter last year – to receive a second PPP loan. The bill would limit these second forgivable loans to entities with 300 or fewer employees and create an additional set aside of funds for businesses with 10 or fewer employees to ensure equitable access to forgivable loans. The bill includes a $10 billion set aside for community lenders to access second draw funds.

PPP Programmatic Improvements: Allow businesses to utilize forgivable PPP funds for personal protective equipment for workers, adaptive investments needed for businesses to operate safely amid the COVID-19 pandemic, and additional expenses. It would also simplify the forgiveness application and documentation requirements for smaller loans under $150,000. Additionally, it would further expand eligibility to certain 501(c)(6) organizations with 300 employees or fewer as well as favorable loan calculations for farmers and ranchers.

Small Business Growth and Domestic Production Investment Facility: Provides for the provision of $10 billion in long-term debt with equity features to registered SBA Small Business Investment Companies (SBICs) that invest in small businesses with significant revenue losses from COVID-19, manufacturing startups in the domestic supply chain, and in low-income communities. Establishes return participation for the SBA in order to recoup the one-time cost of the investment.

The bill was sent to the Senate Small Business Committee on Monday. So far, Collins is the only cosponsor. There is no companion bill over in the U.S. House.

Reach Kevin Derby at kevin.derby@floridadaily.com.