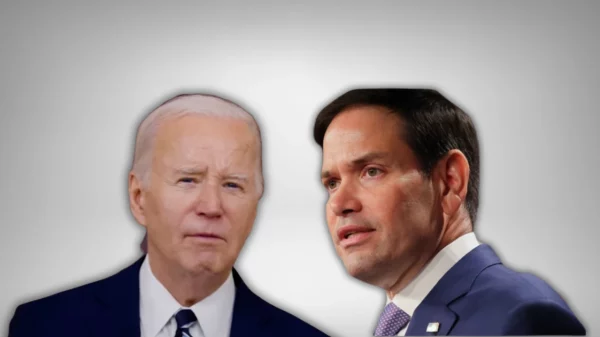

This week, U.S. Sen. Marco Rubio, R-Fla., the chairman of the U.S. Senate Small Business and Entrepreneurship Committee, urged Jovita Carranza, the administrator of the U.S. Small Business Administration (SBA) and U.S. Treasury Sec. Steven Mnuchin to create certainty for Paycheck Protection Program (PPP) borrowers on the borrower certification requirements.

The CARES Act required that a borrower must certify in good faith that they have been harmed by the coronavirus pandemic and do not have access to other liquidity. SBA has issued guidance that businesses who cannot certify in good faith must return their PPP loan by May 14, 2020.

This week, the Treasury and SBA released question #46 of their Frequently Asked Questions (FAQ), which follows Rubio’s suggestions and provides a safe harbor to PPP borrowers who received a loan for under $2 million certifying that they took out the PPP loan in good faith. This will provide certainty to 99 percent of PPP borrowers and focus SBA’s audit capabilities on the 1 percent of larger loans approved in the program.

The full text of the letter is below.

Dear Secretary Mnuchin and Administrator Carranza:

Thank you for your May 11 letter requesting my views on potential safe harbor guidance for borrowers’ good faith certification of need for participation in the Paycheck Protection Program. I appreciate the Administration’s willingness to work with Congress as you implement this critical program. As Congress has recognized, the urgency of the need for the program has made necessary foregoing conventional forms of notice and comment. At the same time, the extraordinary level of public interest in the program demands that elected representatives in Congress provide feedback essential to its successful operation.

Given the amount of uncertainty surrounding borrower certification, I would support a broad declaration that all loans under $2 million will be presumed to have been applied for in good faith. This would ensure that over 99 percent of borrowers can be certain that they were eligible for the loan. Beyond this threshold, I suggest the below criteria for certification of need.

The goal of the Paycheck Protection Program is to preserve employment. Congress’ view in creating the program was that workers are durable features of the business firm. As the American economy entered a period of great uncertainty, Congress enacted the program in order to help eligible businesses keep their workers on payroll.

The natural implication of this clear goal of payroll support is that to apply for the loan in good faith is to apply for the loan for the purpose of retaining employment. Workers are what is necessary to the operation of the business. My view is that at a minimum, the very small percentage of loan recipients over the threshold the Administration has set for a presumption of good faith should demonstrate that they did not reduce their employment. If a business took a loan and still laid off workers, then it should be presumed that they did not apply for the loan to maintain payroll, but rather as a source of credit on highly favorable terms for a firm of their size.

In addition to being most consistent with the fundamental goal of the program, a focus on employee retention would avoid problems associated with other possible standards of need. Businesses that are eligible for the program by statute cover a wide variety of business models with different capital allocation conventions. A definition of need based upon access to finance could harm the program’s goal of employee retention. For example, some manufacturing businesses hold a liquid buffer as insurance against the failure of high-cost, long-term research and development projects. We should not penalize manufacturers just because this is what their business model requires. Similarly, due to volatility in equity markets, publicly-traded businesses are often under more pressure than privately-owned businesses to reduce employment in order to cut costs. It was for these reasons, among others, that Congress waived the requirement that businesses demonstrate they could not raise capital elsewhere in order to receive an SBA loan.

Likewise, standards which rely on the demonstration of a decrease in revenue would arbitrarily make ineligible businesses that need the loan to maintain payroll. Many businesses have volatile revenue flows, and receive current payment for services rendered or products sold in prior time periods. Government contractors and construction businesses are prime examples of this. It was for this reason, among others, that Congress did not include a revenue test for certifying the application for a loan in good faith.

The Paycheck Protection Program has already saved tens of millions of jobs. In its second round of funding, millions of the smallest businesses, sole proprietors, and independent contractors have now been able to obtain funding through this program. At the same time, we face an unemployment rate last seen during the Great Depression. As the Administration continues to implement the program, I believe that a faithful interpretation of statute to equate need with employee retention would be supported by Congress and justified by the needs of the crisis.