A new report from personal finance news website WalletHub reveals that Florida ranks among the top ten states where auto loan debt is increasing the most.

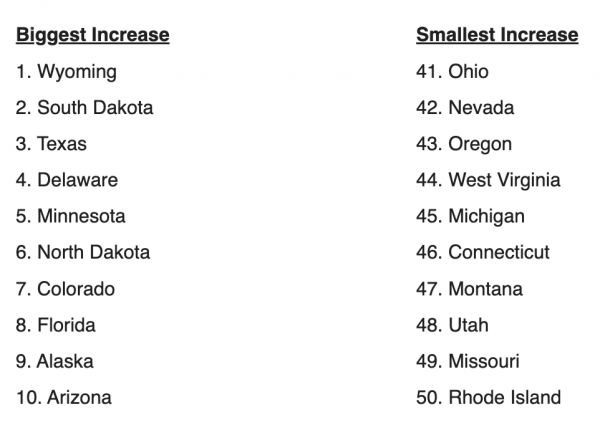

Among the 50 states, Florida ranked eighth for increasing auto loan debt, but delinquent car payments aren’t a problem unique to the Sunshine State. According to WalletHuh, the United States currently owes a total of $1.6 trillion in total auto loan debt, with the average household in America owing over $13,400, as of Q3 2023. The average debt figure is just a few hundred dollars below the all-time high. Two states commonly known as “flyover states” ranked among the states with the biggest debt increases, with, Wyoming ranking first and South Dakota ranking second.

“A few states had more dramatic increases, as high as around 3%, which suggests that people in some states are more affected by inflation in car prices or are biting off more than they can chew when it comes to loans,” said John Kiernan, editor of WalletHub.

Methodology:

In order to determine the states with the largest auto loan debt increases, WalletHub compared the 50 states across two key dimensions: 1) Change in Auto Loan Debt and 2) Average Auto Loan Balance & Monthly Payment.

We evaluated the states using three individual metrics, which drew from WalletHub’s proprietary data on consumer debt. The metrics are listed below with their corresponding weights, each metric being graded on a 100-point scale.

Finally, we determined each state’s weighted average across all metrics to calculate its overall score and used the resulting scores to rank-order our sample.

Change in Auto Loan Debt – Total Points: 70

Change in Average Auto Loan Balance (per Tradeline) – Q4 2023 vs Q3 2023: Full Weight (~70.00 Points)

Average Auto Loan Balance & Monthly Payment – Total Points: 30

Average Auto Loan Debt Balance (per Tradeline) Q4 2023: Full Weight (~15.00 Points)

Average Monthly Auto Loan Payment (per Tradeline) Q4 2023: Full Weight (~15.00 Points)

Sources: Data used to create this ranking were collected as of January 11, 2024 from WalletHub database.